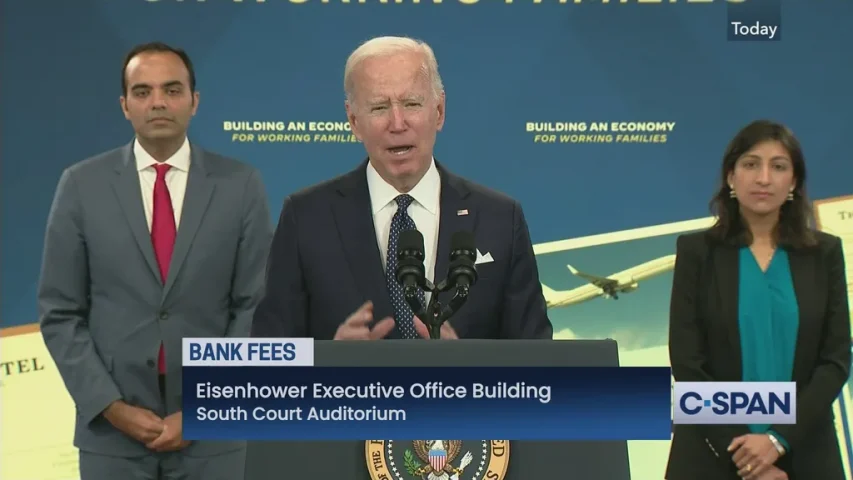

Biden Using ESG to Force People with Good Credit to Subsidize Those with Bad Credit – in the Name of ‘Equity’, by Craig Bannister

A Speech That Convinced a Dutch Philoshopher to be Catholic, by Paul Brock III

April 26, 2023

The Two Lords of the World – and Us, by Robert Royal

April 26, 2023

The fee, which was instituted by a Biden Administration rule – not by Congress – adds about $40 more a month ($480 per year) to the mortgages of those with credit scores of 680 buying homes in the $400,000 range... The new fee is part of the environmental, social and governance (ESG) movement, which seeks to impose liberal ideology on businesses and, by extension, American citizens.